New

Raising Capital (Second Edition) - Get The Money You Need To Grow Your Business

Raising Capital (Second Edition) - Get The Money You Need To Grow Your Business

Andrew J Sherman

Age (years) : 18 - 99

Couldn't load pickup availability

Whether your business is just a gleam in your eye, a newly launched operation, or a full-fledged firm that's humming right along, you'll never experience real growth without a substantial infusion of cash. Long gone are the days when venture capital groups seemed to pour millions into every ""next big thing."" Now it's clear that there is real competition for investors, and that only the most viable businesses -- and carefully executed fundraising -- will reap the capital necessary to drive continuous growth.

Raising Capital is the definitive guide for entrepreneurs and growing companies that need to raise capital. The book covers every phase of the growth cycle, and provides tools for building business plans, preparing loan proposals, drafting offering materials, and much more. Now in its second edition, Raising Capital includes a wide variety of updates to reflect the realities of the post-dot-com bust, new trends in private equity markets, and the impact of the Sarbanes-Oxley Act, a crucial piece of legislation that establishes new corporate governance requirements in the wake of high-profile accounting scandals.

The book takes you through every stage of the capital process, and provides a bevy of alternatives to evaluate in determining your company's capital strategy. The four parts cover:

* Getting Ready to Raise Capital: capital-formation strategies, plus recent trends; understanding legal and governance structures and how they affect your ability to raise and use capital; and the role your business plan plays in securing capital

* Early-Stage Financing: start-up financing; ""bootstrapping,"" or doing less with more at a stage in your business where ""cash is king""; private placements versus commercial lending; leasing, factoring, and government programs

* Growth Financing: strategies for obtaining venture capital; how venture capital transactions work; preparing for and executing an initial public offering (IPO)

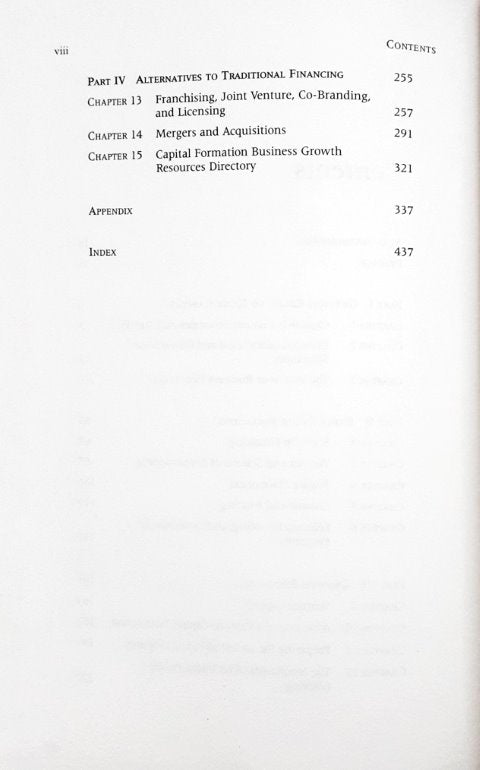

* Alternatives to Traditional Financing: franchising, joint ventures, co-branding, licensing, and other strategic alliances; mergers and acquisitions; plus the Capital Formation Business Growth Resources Directory

Raising Capital provides a huge selection of checklists, charts, sample forms to expedite the capital formation process, and the author relates eye-opening ""war stories"" and perspectives from the investor's side of the table that will help you avoid pitfalls and guide your business confidently through every growth stage. Featuring comprehensive coverage of all recognized capital strategies, this timely book will help you navigate the murky (and often rough) waters of capital formation."

- Details

Publisher : American Management Association

Format : Hardcover

Language : English

Content : Non-Fiction

Style : Non-Illustrated

ISBN : 9780814408568

Size : Large

SKU : BY9-952

Genre : Finance / Business

Share